Invoicing Basics For Small Business Owners

abs

September 1, 2025

INVOICING BASICS FOR SMALL BUSINESS OWNERS

If you own a small business, always keep your eyes on the cash flow. That is why you need effective and timely invoicing. This blog, designed to be easily understood, will delve into some invoicing basics that you, as a small business owner, can master.

What Is Invoicing

As a small business owner, you should know that managing invoicing is important. An invoice is a legal document that itemises and records each transaction between you and your customer. This document confirms products purchased by a customer and the amount agreed to be paid for those products or even services.

Components of an Invoice

1. Invoice Number

Each invoice should have its unique reference number, and you should keep a record of these numbers. That is why you also need a bookkeeping system in your business. Your customers will use these numbers to keep track of invoice payments on their end.

Number your invoices sequentially, beginning with the lowest number (e.g., 1 or 0001) and incrementally assigning the next number to each subsequent invoice. This is known as your ‘invoice numbering system ‘. Consider incorporating letters into your invoice numbering system to enhance organisation and clarity. This system is crucial as it helps you and your customers keep track of invoice payments, making your invoicing process more efficient.

2. Date

The invoice creation date is vital as it sets the ‘payment due date ‘, which is the date by which the customer is expected to make the payment. This due date is crucial for managing your cash flow and identifying if the invoice is overdue, requiring prompt follow-up. It’s important to communicate this date clearly to your customers to ensure timely payments.

3. Company Details

Ensure every invoice contains your essential business details: company name, address, phone number, and email address. If applicable to the transaction, include your VAT ID. These details should be prominently positioned at the top of the invoice. They serve as your business’s identification and help your customers maintain accurate records. They also make it easier for your customers to contact you if they have any questions or concerns about the invoice.

4. Client Information

At the top of your invoice, you should include customer information in the same format as your company details. This information should comprise the customer’s name, billing address, shipping address (if different from the billing address), phone number, and email address. This information is crucial for maintaining accurate records and facilitating communication with your customers. It also helps you ensure the invoice is sent to the correct person and address, reducing the risk of payment delays or disputes.

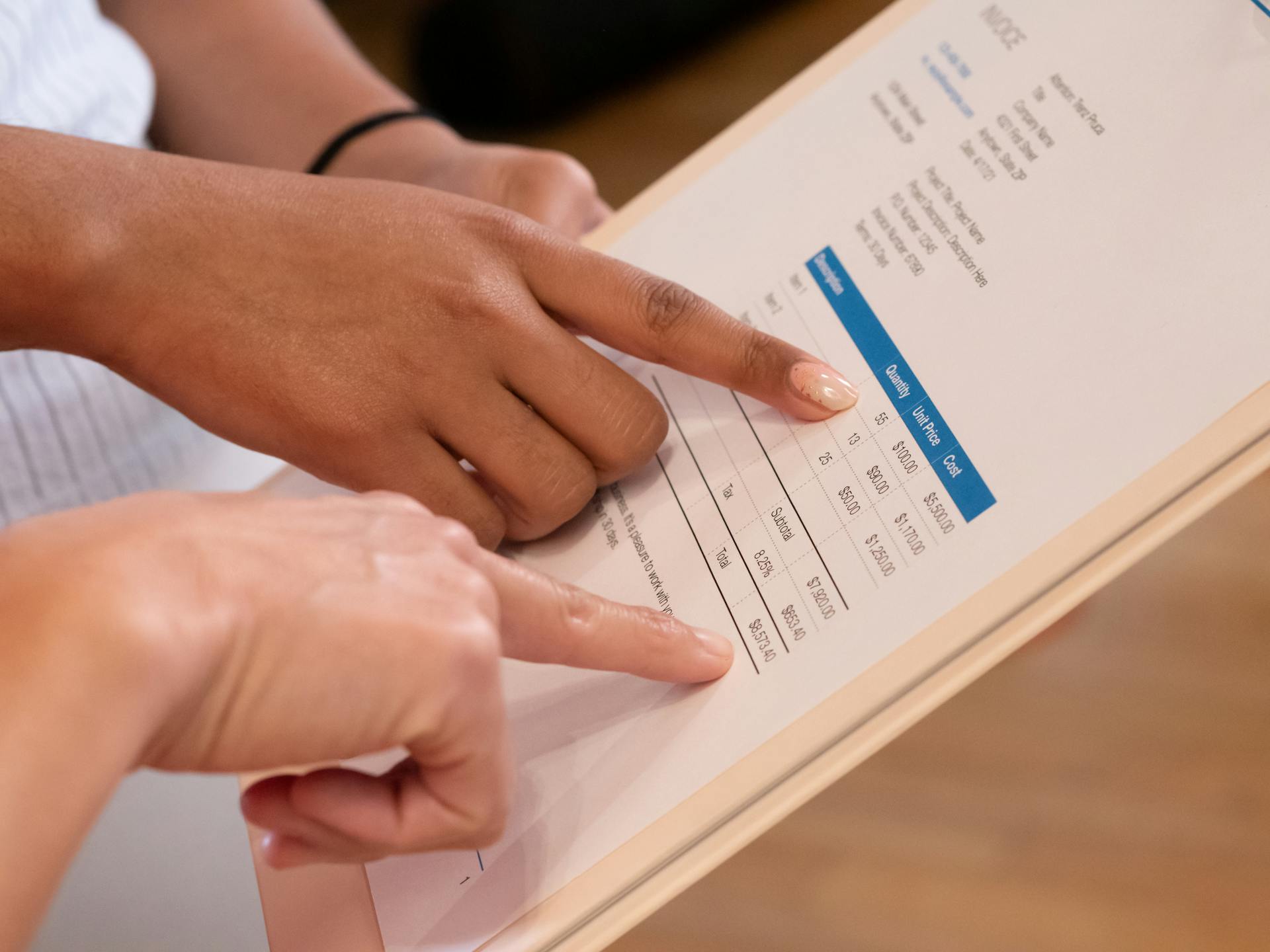

5. Itemised List of Goods or Services

This section of the invoice, known as the ‘itemised list of goods or services ‘, provides a detailed breakdown of the goods sold or services rendered. Each item should be listed along with its description, quantity, unit price, and total amount. This detailed list ensures transparency and clarity for both the seller and the buyer regarding the products or services invoiced, helping avoid misunderstandings or disputes.

6. Payment Terms

Payment terms specify the conditions under which the buyer agrees to pay the seller for the goods or services provided. These terms outline the timeframe for payment, including any applicable discounts for early payment and penalties for late payment.

Common payment terms include:

Net X: Payment is due within X days of the invoice date. Common examples include net 7, net 30, net 60, and net 90. Customers typically wait until this date to make their payment.

Payment in Advance (PIA): Full payment required before fulfilling the order or completing the work.

Cash in Advance (CIA): Similar to PIA, payment is made in cash before fulfilling the order or completing the work.

Upon Receipt: Payment is expected when the customer receives the invoice, usually the next business day.

End-of-Month (EOM): Payment is due by the end of the same calendar month as the invoice date.

15th of Month Following Invoice (15MFI): Payment due by the 15th of the month following the invoice date.

50% Upfront: This method requires requesting 50% of the total invoice amount before fulfilling the order or completing the work. It is often used for larger orders and projects.

7. Total Amount Due

Highlight the invoice number, as it’s the most crucial information for your customer and the primary reason for issuing the invoice. The invoice number is a unique identifier for each invoice and plays a significant role in the invoicing process. It helps you and your customers track payments, making it easier to manage your cash flow and ensure timely payments.

Calculate the subtotal by adding up all line totals. If you don’t apply sales tax or VAT, the subtotal is also the total amount due.

If a sales tax is applicable, specify the tax rate being charged. Multiply the subtotal by the sales tax rate, then add the resulting tax amount to the total due.

Different Types of Invoices

1. Standard Invoice

This is the most common type of invoice used for one-time sales transactions. It is issued to customers for goods or services provided at a specific time. A standard invoice typically includes the invoice number, date, itemised list of products or services, quantity, unit price, total amount due, payment terms, and seller’s information.

2. Recurring Invoice

A recurring invoice is used for ongoing or subscription-based services where payments are made at regular intervals. It is automatically generated and sent to customers on a recurring basis, such as monthly or annually. This type of invoice benefits businesses that provide services regularly, such as software subscriptions or maintenance services. Automating the invoicing process saves time and effort and ensures a steady cash flow for your business.

3. Proforma Invoice

A proforma invoice is a preliminary invoice provided to the buyer before the goods or services are delivered. This type of invoice outlines the terms of sale, including the description of goods or services, quantities, prices, and other relevant details.

However, a proforma invoice is not a legally binding document like a standard invoice but serves as a quotation or estimate for the buyer. It may include terms of sale, shipping information, and payment terms to facilitate agreement between the buyer and seller before finalising the transaction.

Importance of Proper Invoicing

With proper invoicing, your business stands to gain these benefits:

Ensuring Timely Payments: Clear and accurate invoices are essential for establishing payment terms, ensuring timely payments, and maintaining professionalism and legal compliance. They streamline the payment process, enhance transparency, and promote a positive brand image.

Professionalism and Brand Image: Well-designed, clear, concise, and error-free invoices reflect professionalism and attention to detail, enhancing your brand image. Consistent branding elements, such as logos and colour schemes, reinforce brand recognition and credibility. This instils client confidence, signalling that your business is organised, reliable, and trustworthy.

Legal Compliance: Properly formatted invoices serve as legal documents, recording transaction terms like pricing, payment terms, and delivery specifics. They aid in legal compliance, ensuring adherence to tax laws and regulations and reducing the risk of penalties or disputes. Detailed invoicing practices also protect audits or legal disputes, offering evidence of transactions and payments.

Don’t miss out on these benefits. Start creating invoices today with BeeBot, a user-friendly tool that simplifies invoicing and gives you the confidence to manage your business’s finances effectively.